Investment Banking 101: Understanding the Industry

Tom Spencer

FEBRUARY 10, 2023

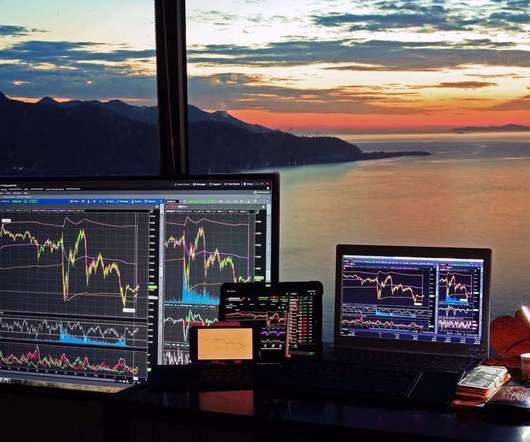

Investment banking forms part of the financial services industry involved in the underwriting, distribution, and trading of securities. What Investment Bankers Do There are several key roles within investment banking, including corporate finance, sales and trading, and research.

Let's personalize your content