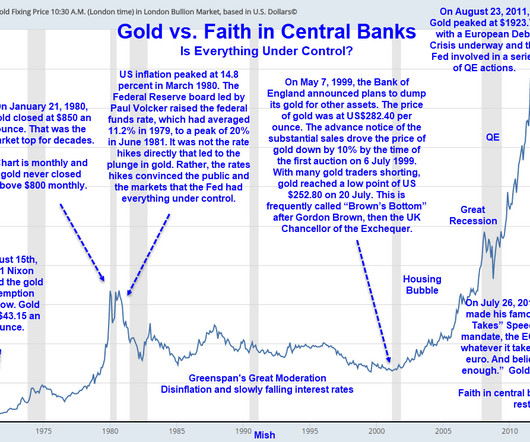

Fed Balance Sheet vs. Stock Market; Will QE Cause Inflation?

MishTalk

AUGUST 7, 2013

Minyanville Business and Market News. Balanced Budget Ammendment Sign the Balanced Budget Petition. China Financial Markets. Market Oracle. Market Ticker. Real Clear Markets. Fed Balance Sheet vs. Stock Market; Will QE Cause Inflation? Fed Balance Sheet vs. Stock Market.

Let's personalize your content